11 Rules that Every Modern Female Breadwinner Needs to Know to Manage Money

11 Rules that Every Modern Female Breadwinner Needs to Know to Manage Money

Originally Posted – June 15, 2018

Most Recent Update – May 2025

Do you have to follow all 11 rules to manage your money better?

Of course not.

But…

Have you ever baked something and skipped a couple of the ingredients?

Unless, you are making a flourless cake, there are some ingredients that are usually important in baked goods – usually flour, butter, or sugar (or some sweetener)?

Managing money is very similar.

While I consider all 11 to be good financial tips for women and fundamentally necessary for women when it comes to managing your money, you are free to apply and act on what makes sense to you.

These rules are the guiding principles for modern women who are ready to regain control of their money and reach their financial goals by using these simple tactics!

So, let’s get into it! If you know you’re ready to make your money make more sense, don’t forget to grab our ULTIMATE FINANCIAL RESOURCE GUIDE TODAY.

Rule #1: Thou Shall Have Financial Boundaries (aka Don’t Let Everyone Borrow Money)

When your family & friends know your payday as well or better than you, WE have a freaking problem.

If they treat your money like it’s “our” money (Spouses excluded, of course), it’s time to wave the white flag.

Don’t be afraid to set boundaries to manage your money better!!

As breadwinners, our budget troubles are sometimes caused by those who abuse our kindness.

It’s okay to say “No” when your loved ones treat you like their personal 1st Federal, ATM, payday loan store, etc.

When I first heard the phrase that “No” was a sentence, I felt crazy empowered.

This was years ago, but it sticks out to me like it was yesterday.

Like…damn…there’s no need to provide an explanation unless I want to.

Sometimes, just pausing and saying absolutely nothing is damn near orgasmic too!

Too far…. Okay, I digress.

If you’re not ready to say “No“ quite yet, here’s another option. Maybe you know the answer is “No,” but you say, “Let me get back to you.”

It’s a straightforward and non-confrontational way to respond.

When you follow up, your answer can start with “I hope you understand…” or “Unfortunately, I won’t be able to….”

Alternatively, you can give a really slow yes. Like a two-month-long, slow yes. Let’s say they ask in May, and you respond in July.

By then, they’ll find an alternative superhero.

Lastly, I’m giving you permission not to follow up at all (not that you need permission from me anyway 😊)

Seriously, sometimes we must be our own protectors.

Don’t be flaky or unreliable.

Be like one of those guards who stand in front of Buckingham Palace.

Regardless of what funny faces or weird antics they see, these soldiers have real boundaries.

They completely ignore you and all the distracting bullshit (well unless you touch them) without breaking position.

It’s actually quite impressive.

That’s who you may have to be. At least, until you are ready to say “No” and mean it.

Guess what happens when people feel like they are being ignored?

They stop calling on you for help.

Have you ever heard the phrase “To whom much is given, much is required?”

Well, much is relative, and sometimes, too damn much is required.

Occasionally, it feels like we might be paying a penalty for our blessings and accomplishments.

Some of us were the

- 1st to graduate from college,

- the only ones in our family who are married

- the only ones who own real estate

- or even the only ones with good credit and the ability to save money.

When you have done those things and family or friends have the audacity to say things like, “Well, you don’t really need the money anyway” or “It’s not like you’re going to miss it,” it can be infuriating.

If you have set realistic financial goals and someone’s “small favor” will stop you from hitting those goals, then you have entered dangerous financial territory.

I urge you to get out!

Be a friend, be an ear, be a shoulder.

But remember that you can’t carry everyone’s burden.

You can’t bail everyone out.

Sometimes it’s okay just to sip tea, listen, be understanding, and do nothing.

Absolutely nothing.

Affirmation: It is safe for me to say “No” and still support the prosperity of others.

Check the FIIRM Approach YouTube channel for information like this

Rule #2: Thou Shall Treat, Not Trick Yourself into Debt (aka Use Credit/Debt to Your Advantage)

Do you ever feel like you are busy but not productive?

You’re doing a bunch of stuff, but it doesn’t really feel like you’re getting anything done.

It’s a weird feeling, and I’ve been there.

I’m usually just checking things off the obligation list when I’m “busy”.

When I’m productive, I focus on things that (1) are important, (2) solve a real problem, or (3) add value to my life.

Here’s the catch.

It’s usually not just one of those qualifications that makes a task productive. It’s when the task covers at least two of the three mentioned.

Here’s the challenge: Think about your purchases in that same way.

If you need to use debt to make the purchase happen, ask yourself the following 3 questions before you make the purchase:

- Is this important?

- Will this purchase solve a real problem (e.g. save you time or save you money)

- Will it add value to my life? (e.g. will it bring me joy, improve my net worth or make my life easier)

Then ask yourself if you are using productive debt or unproductive debt to purchase it.

Wait, What??

Unproductive debt purchases = Have no tax benefits, have high-interest rates or high fees, and usually don’t improve our net worth.

Plus, we often regret the purchases because it’s not an ideal way to spend our money.

Productive debt purchases = No to Low interest rates & fees, tax deductions, and usually support an increase in net worth.

Examples of productive debt purchases are rental properties, building or buying a business, buying a house, and continuing your education (sometimes).

With the cost of living in America, it’s hard not to use unproductive debt sometimes.

However, the less you rely on it, the better.

Debt & credit is a little like ice cream.

There are many options, but too much of it can be hazardous to your waistline.

Just like you can’t eat chocolate chip cookie dough ice cream every day (although I wish I could) and NOT work it off, you CANNOT charge everything to your credit cards and not pay it off!

When you have good credit, it can help you:

- make more money

- land the right job

- take amazing vacations

- manage your bills in a stress-free way

- cover random but expensive emergencies

However, one of the biggest benefits is that it can help you get out of debt.

We often go into debt over our love for expensive shoes, clothes, fancy trips, not saying “no” enough to our kids or whatever your spending trigger may be.

Let’s remember that we can use credit strategically to help you build the life you want!

Discipline and self-control is like a superpower when it comes to credit but it definitely requires some practice and grace. (See Rule #6)

Affirmation #1: I am minimizing to prepare for increase.

Rule #3: Thou Shall Not Turn a Blind Eye to Managing Money (Keep an Eye on Your Money Always)

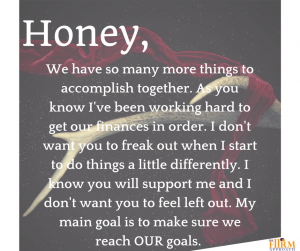

Just because you don’t THINK you are good with managing money doesn’t mean you shouldn’t have a say with your finances, especially if your partner has opportunities to improve how you manage money.

Maybe your spouse or partner is really good with money, and you find yourself saying:

“My husband handles everything I don’t have to deal with any of that crap.”

“I don’t know exactly how much money we have in the bank.”

“If something happened to _____ (insert partner or parent name), I would be in trouble… LOL”

Sorry, not sorry, but this is NOT the best way to protect your financial security!!

Sure, it’s my opinion, and it may not be one that you share, but for those who are wondering if this is a smart way to manage their financial lives, I’m here to tell you that it very rarely is.

I cringe when I hear people talk about their money in such a lackadaisical way because of the three D’s – disability, death, and divorce.

That’s enough D’s to motivate me to get my Ass-ets in order!

Even if you’re single, pull the covers from over your head and look your money straight in the eye.

DO NOT give full control of your finances to anyone or anything – not a relative, a spouse, a financial advisor, or even the signs in the sky.

It is no longer the 50’s and 60s.

Our parents and grandparents lived differently due to the constraints and traditions of THEIR time.

We must adjust to OUR time.

Hence, the reason these are called “MODERN RULES.”

Unlike generations before:

- Women can get credit in their own names today.

- Women work outside of the home and still raise children.

- It is much more acceptable for women to express independent thoughts and goals.

Your own personal preferences are one thing, but make sure you understand the reason for your preferences.

“My mother never did it that way,” or “that’s the way it’s always been done in my family,” is not the best reason.

This rule is about being FIIRM and summoning the courage to confront your money and your relationship with it.

I really want you to look your money straight in the eye!

You are in control and get to tell it what to do, but at a minimum, you get to know where it’s going and how it’s growing.

Affirmation: I am learning to face my challenges with money head-on.

Rule #4: Thou Shall Save the Bacon, Not the Grease (aka Make Saving Money a Priority)

You bring home the bacon (money), use it for bills and necessities, and sometimes save whatever is left.

So many of us have not been taught to prioritize saving money.

We haven’t learned the importance of paying ourselves first and seeing the benefit of compounding interest.

All too often, saving money is an afterthought when we really should be paying ourselves first. It needs to be an actual line item in the budget.

Trust yourself to put money away and not touch it unless you truly need to.

Save for the obvious things that will grow into bigger, more expensive problems.

Oil changes are necessary. . . so are doctor’s appointments.

Toothaches can become root canals.

Leaky pipes can cause mold.

As much as possible, take care of the small things early & often so they don’t become big things later.

$100 may seem like a lot of money today, but I’d rather pay today than $500 a month from now.

Affirmation: I trust myself with large sums of money

Rule #5: Thou Shall Rock the Cradle (Make Retirement Savings a Priority)

Speaking of now putting ourselves first…

We are taught to put ourselves last, especially when it comes to our children.

Don’t get me wrong, kids are great (I even have one 😊) and their well-being is essential, but when it comes to our children + money, sometimes WE HAVE TO put ourselves first.

Give yourself the proper “project runway” to retire comfortably by investing early.

That may mean telling them no more often than we’d like.

Or just changing the plan because money is fun.

You can’t get a loan to retire (although I’m sure someone is working on this idea somewhere).

Trust me – you can be a good mom and be good to your financial future at the same time.

Often, we miss out on an easy entry into retirement savings by not contributing to a 401K or 403B.

We feel like IRA and IRS sound too closely related and we stay far away because we don’t understand how they work.

Here’s how I want you to think about it.

Making the decision to invest in your retirement as early as possible may seem challenging because of all your other expenses.

But it is foundational to your future lifestyle.

Remember the hand that rocks the cradle rules the world.

Let’s rock and roll, baby!

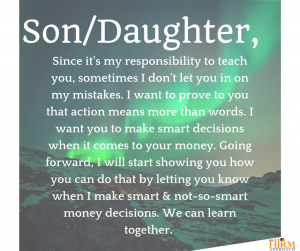

Our children follow more of what they see than what we say.

So, SHOW them how to retire comfortably!!

Affirmation: I don’t have to be perfect to make better decisions

Rule #6: Thou Shall Practice Self-Compassion Daily (Forgive Your Money Mistakes)

Lack of forgiveness can cause self-destructive behavior.

We all mess up.

No one is PERFECT.

Period.

Mistakes made today won’t be your last.

Just try not to repeat the same mistakes repeatedly because, well…you know…that insanity thing.

Remember WHY you are working towards your financial goals and allow yourself some grace.

Make your losses your lessons and remember to treat yourself when you hit your financial goals – big or SMALL!

You should reap the rewards of your good decisions.

Ideas to treat yourself include:

- Eat a fantastic meal. I am talking about the ones that make you moan after the first bite. Bring a friend… or not. (I am the queen of dining alone)

- Find a great Coupon/Groupon for a new adventure in your area.

- Have a dance party in your living room. Invite your friends… or not 😊

- Buy yourself some chocolate, flowers or a sexy new dress.

- Stay a night in your favorite hotel for reason at all.

- Get a massage in your own home.

- Buy your favorite candles, wine, and have a sexy night of reflection or journaling (you thought I was going to say something else, didn’t you)

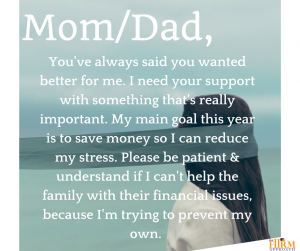

If you often feel down, discouraged, or even depressed, rewarding yourself with small treats may not be enough.

You may need a bigger treat from a life coach, therapist, counselor, or other professional who can help you sort things out.

Trust me, peace of mind is a treat unto itself.

I encourage you to pull your big girl panties all the way up and get jiggy with this money rule!

Affirmation: I don’t have to be perfect to make better decisions

Rule #7: Thou Shall Not Be Foolish (aka Make Rationale Money Decisions)

Now I know I just told you to treat yourself and have some self-compassion buuuuut…

Treating yourself for a job well done requires some level of discernment.

The treat likely shouldn’t involve your entire paycheck!

I don’t think you really need me to explain this much more, but some examples would include:

- co-signing for the unemployed

- lending money you can’t afford to lose

- purchasing a car without understanding the terms

- investing your life savings in the stock market

- buying a car based on a new job, you MIGHT get

- ignoring letters from creditors

- ignoring letters from the IRS

- spending your entire paycheck every single payday

- participating in fraudulent activity with a loved one

- allowing someone else to control your accounts and spending

- spending your rent money on concert tickets (even if it is Yoncé or Adele, sorry Beehive)

You get my point. 😊

Foolish behavior means you are hedging your bet when the odds are stacked against you.

If you’re looking for a way to avoid reaching your financial goals, any of the above will do.

However, for those who are looking for the winner-winner-chicken-dinner rule to live by, this should be towards the top of your list.

Affirmation: I am focused financially on my future

If you are ready to TAKE ACTION and work on your finances take the first step and click here and grab your copy of the Ultimate Financial Resource Guide!

Rule #8: Thou Shall Not Put All Your Eggs in 1 Basket (Enough Said)

This money rule goes well with #3 -Thou Shall Not Turn a Blind Eye to Money.

This applies to people, bank accounts, investments, and income streams.

This rule is not about your spouse’s, partner’s, soon-to-be-ex, or parent’s ability to provide for you.

I’m sure “they is nice, they is kind and they is smart” (hoping you’ve seen the movie “The Help”)

This rule is about recognizing that one day, they may not be able to or choose not to provide the way they always have.

Plus, the concept of job security is just that. It is more conceptual than a reality for most of us.

It is becoming even rarer to find someone who has worked at the same company for their entire career.

Half the battle of reaching your financial dreams is being aware of the areas you are exposed to risk.

That possibility could be by choice or by force; either way, you need to be prepared for it.

Mini Lesson: Seek multiple streams of income

Furthermore, having an account compromised and fraudulent charges hitting your primary bank account is no fun.

Generally, banks are quick to respond and resolve the issue but there are times when the resolution is delayed.

When this happens, your life may come to a standstill or become disrupted because you don’t have access to your money.

Lesson: Don’t leave all your money in a single bank account.

These examples are modern reasons to diversify.

Financial stability & independence embrace diversity.

Think about the areas of your life where you need to minimize the risk if you lose your job, get divorced, or experience something crazy like a pandemic.

Affirmation: I deeply appreciate my blessings, and I value the lessons money teaches me.

Rule #9: Thou Shall Create, Not Wait to Make More Money

Rule #8 leads us to Rule #9.

Whether it’s asking for a raise, applying for a new job, starting a new business, or seeking out some extra pocket money, you have to be proactive.

Please don’t doubt your self-worth. We all struggle with it at some point and it can continuously resurface and stop us from pursuing our financial goals.

It’s ok to ask for raise. The worse that can happen is that they say “No”.

It is not a bad thing to want to make more money.

If you’ve been saying for years that you need to do something to get more money, this commandment gives you permission to act TODAY!

So, let’s get to work!

*Cue Rihanna*

Affirmation: I deserve to attract and retain money

Rule #10: Thou Shall Let Auto Take Control ( aka Learn to Manage Your Money with Less Stress)

Auto-mate, Auto-pay, and Auto-debit should be your money partners in crime.

Automating your bills is one of the most empowering things you can do. You are telling the universe that you are in control of your money.

You are telling the universe that you choose not to stress about paying your bills on time.

While automating requires a bit of strategy it doesn’t have to be super complicated.

What’s even better about ‘Auto’ is that you can dump him anytime you want if you find that it’s just not a good fit for you!

Plus, ‘Auto’ is the ex who will never show up in the middle of the night begging you to take him back. 😊

You are in complete control, even when things are on autopilot.

Automating your savings (See Rule #4) is another set-it-and-forget strategy that you can always turn off when you need to.

Affirmation: It is safe for me to be responsible and prepare for future increases.

Rule #11: Thou Shall Have a Money Bench

One of the biggest fallacies is that you must be wealthy to have a money team, and that’s just not true.

It’s so important that we receive financial advice with the unique needs of women in mind.

Having a trusted team of professionals that can help you through major transitions is helpful for anyone who earns income, owns assets, has debt, plans to marry, plans to divorce, or plans to retire.

In addition to attorneys, insurance agents, and tax professionals, there are many modern resources and financial professionals who can provide valuable insights to help you save money, protect your assets, and make important financial decisions.

Check out our ULTIMATE FINANCIAL RESOURCE GUIDE TODAY to learn more about those resources and financial professionals.

Think about building your money bench as an investment in your financial future versus an ancillary expense.

Affirmation: I value information and expertise to help me reach my financial goals.

Take FIIRM Hero Action to Manage Your Money

Over the years, I’ve gained a greater appreciation for affirmations.

After all, words have power, and that’s why this blog post includes affirmations after each money rule.

When you feel like your resilience is being challenged in the abovementioned areas, take some major deep breaths and repeat the relevant affirmation at least 3-5x aloud.

As an alternative, when you feel your willpower is being tested, refer to the rules and write the affirmations down!

Guess what goes great with affirmations!

In addition to the affirmations, use the rules to create a plan for managing your money.

If you know a friend or relative who could use some help with their money, send them the link to this blog post.

Be patient, and you’ll be sure to see progress!

Looking for SUPPORT…

You need something to help you stay inspired and on track! Don’t forget to grab your copy of our ULTIMATE FINANCIAL RESOURCE GUIDE TODAY.

Nikki Tucker

Founder & Managing Director of The FIIRM Approach

Nikki is a Blogger, Speaker, and primary financial strategist of The FIIRM Approach. As a mom, 20+year financial services professional, and Certified Divorce Financial Analyst ® she is committed to helping female breadwinners strategically prepare their finances for divorce and confidently maintain their financial security pre and post divorce. Nikki uses action-based education in her Bring Home the Bacon workshops and strategy sessions as well as her on-demand digital resource – Silent Preparation Series - so you can prepare your finances for life's major transitions.

TAKE ACTION TODAY & LEARN about the simple things that can help make your pre & post divorce life easier - Grab Your Complimentary Divorce Support Pack today

Recent Comments