How to Make Money Conversations Less Awkward

Stop whatcha doin’, cuz I’m about to ruin…

(If you know the song, I bet you couldn’t help finishing that line)

I actually only want to ruin your belief that money conversations are awkward or hard.

That’s it. Simple, right?

I know that discussions about money can be uncomfortable and as humans we naturally fight any discomfort.

Just think about the last time you were in an elevator.

When you entered, maybe there was one person already there. You walked to the opposite wall of the elevator.

Maybe you exchange verbal pleasantries, maybe not.

For the next 10-20 seconds, you plan to ride in silence, avoid making eye contact and stare at the elevator buttons as if they’re the most fascinating you’ve ever seen.

Then you realize there’s a foul odor (I mean F-O-U-L) and you’re trying to figure out if it’s really possible for a smell like that to be coming from this unknown human nearby.

Ding! Time to get off (Thank God)!

Maybe you say goodbye as you hurry off at your floor ( likely not because you were holding your breath until the coast is clear!)

Those few seconds of awkwardness don’t stop you from riding elevators because they are a necessity for you to get things done efficiently.

Guess what! So are your money conversations (wink, wink)

While it might not be worth your time to address the awkwardness in elevators, it’s a worthwhile effort to make your money conversations less awkward with your family and friends.

Money conversations can cover numerous topics and therefore spur a ton of emotions.

If you want your family to be open with you about their financial goals and concerns then you first, have to be open with them.

Give a little, get a little…

While my previous blog post focused on marriage and how to keep money fights to a minimum, this post shows you ways to jumpstart the conversation with your family and friends about your intentions around your financial goals.

If you want to help make your money conversations less awkward, then it’s important to start with transparency.

Use transparency to knock discomfort the hell out of your way.

Just be sure that your tone matches your intentions. For example, starting a conversation off with “we need to talk” is probably not the best idea.

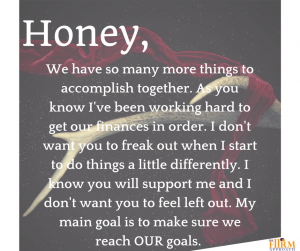

Romantic Relationships

In case you need a little more help talking to the love of your life, I thought we could start here.

When there have been financial mistakes in a relationship they need to be acknowledged before you can move on.

First, accept responsibility for your mistakes, then make sure you show empathy for your partner’s mistakes.

This helps your discussions start in a neutral position and can help your partner accept the impending change.

A script similar to the one below can be used as a starting point to get your partner to understand your perspective.

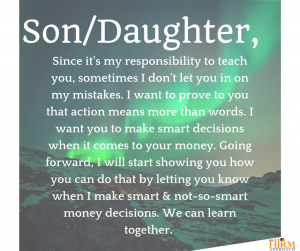

Parental Relationships

Your money conversations do have to be like elevator rides. You don’t have to get on and off at the same floors every day. Visit different topics depending on the areas of your life that require the most attention.

This is particularly important when it comes to having money conversations with your parents or your children.

It is common to hit roadblocks when talking about finances with your family as some topics are inherently more uncomfortable than others.

When you are the breadwinner and you live pretty comfortably sometimes your children (adult and minor children) behave as if money falls off trees or like your paycheck is THEIR paycheck.

At times, your parents might be guilty of this too.

If this is the case, it may be time for a change.

That message of change may be hard for you to deliver and harder for your loved ones to hear.

The scripts below may be a helpful way to inform the family that a changing is coming!

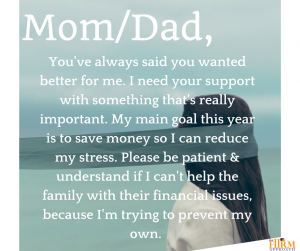

Platonic Relationships

Are you the friend that can’t say “No”?

Do you have plans to save money but feel bad turning down a night of tequila and tacos with your best friends?

Do you genuinely just want to go because you love life and you love having a good time (plus you love tacos and tequila)?

When you don’t have the discipline to say NO, you need to empower your inner circle to hold you accountable. Give them permission to speak up when you might be falling off track of reaching your financial goals.

Talk to them about the support you need and allow them to be a part of your progress.

Using a script similar to the one below can help you get support and make saying NO much less awkward.

Craft your jump start script based on your own personal relationship dynamics and communicate with patience and genuineness.

Shifting your relationship with money takes time and requires patience with yourself. Getting your family on board requires, even more, patience and understanding.

The next time you get on the elevator, speak up and acknowledge everyone who’s on. It may feel pretty weird but you’re really just pushing past some discomfort. It’s merely a lab test and they’re the test dummies.

Some may respond to you and some may not, but you did your part by kicking off a conversation.

Over the years, I’ve had learned some pretty interesting things about strangers while on an elevator.

Imagine what your family can learn about you and how easy your family money conversations could be if you set the stage properly.

Nikki Tucker

Founder & Managing Director

Nikki is a 16-year financial services professional, a Certified Divorce Financial Analyst ®, and the primary divorce financial strategist for The FIIRM Approach. She helps female breadwinners prepare for divorce to avoid common financial mistakes and confidently maintain their financial security. She uses proven strategies within the FIIRM Approach methodology so her clients can manage their money, debt, and credit in their new financial life. TAKE ACTION & LEARN about the tools that can help make your new money life easier. Grab your FREE Ultimate Resource Guide HERE.